Experts are not fazed by upside surprises in economic growth, which implies increased acceptance of the possibility that inflation can be constrained without a recession.

Weekly Economic Outlook

04/23/2024

What GDP Projections Say About Projecting GDP in a Post-Covid Economy

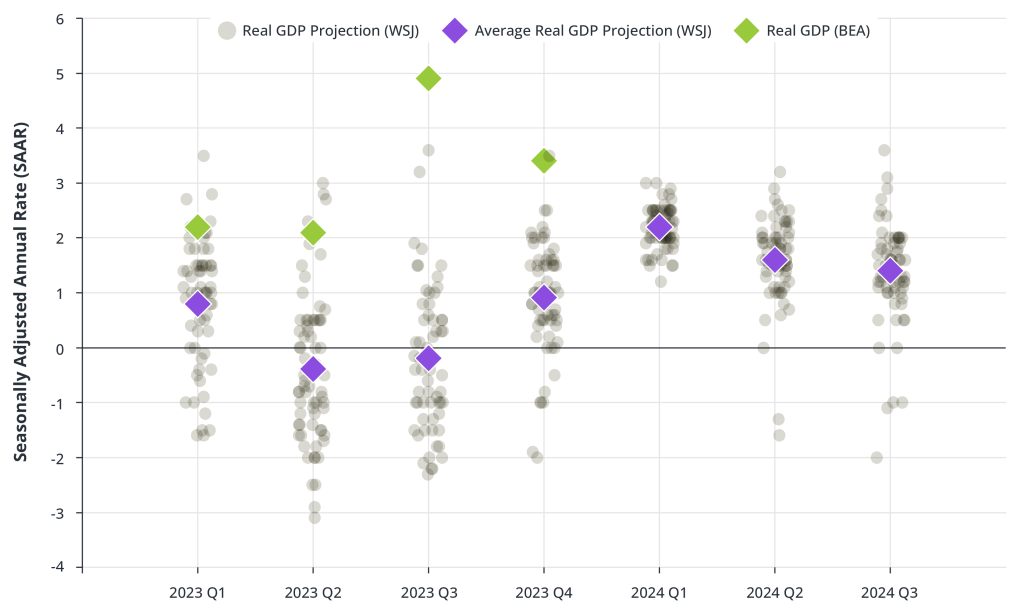

This Thursday, the Bureau of Economic Analysis will release initial estimates of economic growth over the first quarter of 2024. While nearly impossible to pinpoint the exact value before its release, the ballpark for estimating economic growth has changed considerably over the past few months. In 2023, many experts expected interest rates to erode economic activity and induce a recession commencing late 2023 or early 2024. Yet, well into 2024 there are few signs that the economy has shifted into neutral or negative growth, as consumer spending, the labor market, and inflation remain strong. Two regular forecasts of economic growth by the Federal Reserve Banks of Atlanta and New York have projected real GDP for 2024 to grow by 2.9% and 2.3%, respectively.

But unlike previous quarters which saw a significant deviation between the predictions and realities of real GDP growth, it appears that many experts are already anticipating another upside surprise. Over the past four quarters, the gap between real GDP growth and median projections, using data from the Wall Street Journal Economic Forecasting Survey, averaged 2.5%. Conversely, if real GDP for 1Q2024 grew by 3%, a considerable feat unto itself, median projections will have missed the mark by 0.7%. Experts are not fazed by upside surprises in economic growth, which implies increased acceptance of the possibility that inflation can be constrained without a recession. Furthermore, these projections suggest a willingness to reconsider the real efficacy of interest rates, particularly after severe economic imbalances such as those which enabled labor market and consumers to retain their resilience after the pandemic. In other words, sustained economic growth is no longer seen as the underdog to rising interest rates.

Weekly Staffing Research Outlook

04/23/2024

Much will depend this coming year on when the Fed decides to begin cutting interest rates, but overall sentiment about the economy is improving.

Has Staffing Demand Hit Bottom?

The U.S. economy has avoided a recession but has not remained unscathed. Ongoing declines in labor churn since 2022’s hiring boom alongside an aggressive tightening campaign by the Federal Reserve have taken their toll on the staffing industry, which saw declines in sales and employment through 2023 and into 2024. The question now is: Has the industry hit bottom—or is there further room to fall?

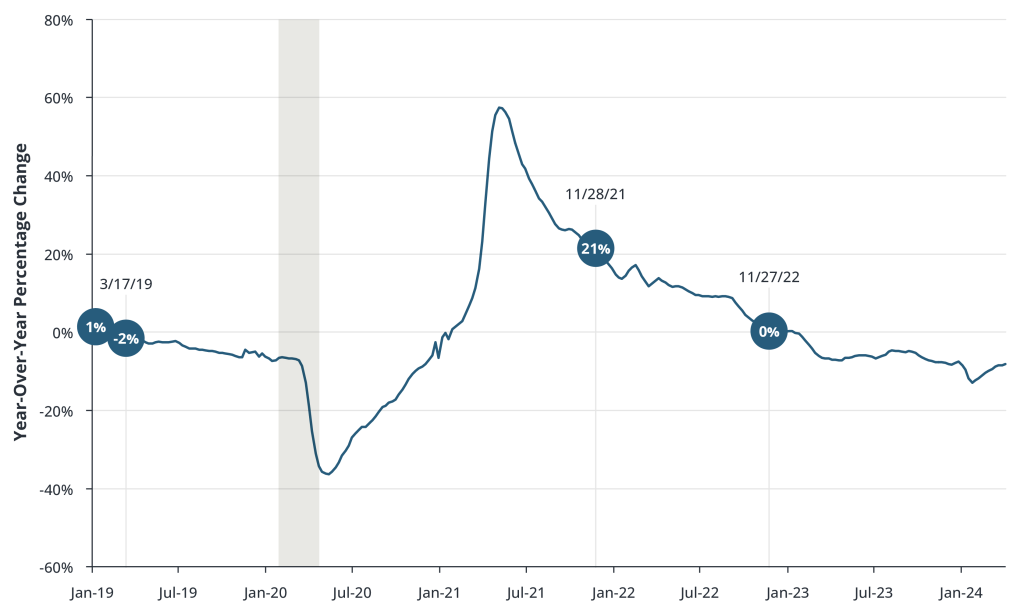

In good news for staffing firms, there are several signs that suggest the industry is bottoming out, starting with the ASA Staffing Index. At a rounded value of 90 as of April 7, 2024, the Staffing Index remains below the corresponding reading from 2019 (93). However, two signs point to a plateau in the Index. First, the four-week average has held at 90 for nine consecutive weeks—a welcome period of stability after a diet of steady declines in 4Q2023. Second, the year-to-year change from 2023 in the four-week average has shrunk for 11 consecutive weeks, as 2024 gains ground against 2023.

Much will depend this coming year on when the Federal Reserve decides to begin cutting interest rates, but overall sentiment about the economy is improving. Economists surveyed by the Wall Street Journal have lowered their probability of recession in the next 12 months from 39% to 29%, and the Vistage CEO Confidence Index rose for the fourth consecutive quarter in 1Q2024. Staffing owners should continue to monitor these trends, but improvement in these measures is an encouraging sign for the industry.

Four-Week Moving Average of the ASA Staffing Index